Amidst the current buzz surrounding interest rates, and the unwillingness for the Bank of Canada to lowering its rate.

We must now shift our attention to something we can control which in this article will be alternative methods for individuals to save money in a challenging borrowing market.

Similar to other market fluctuations where costs surge, there are two primary approaches to maximizing savings.

Licence #M18002043

Advanced Method For Reducing Interest Expenses

The initial approach involves ignoring the issue altogether, hoping it will dissipate. We often witness borrowers sidestepping the details of renewal letters, only to face a stark increase in rates later on.

The alternative approach is to delve into the finer details that borrowers can influence.

Let's delve deeper into this second approach. It's understood that if you're facing a renewal this year, your borrowing rate will likely increase. However, this leaves borrowers with options.

A strategic move for borrowers in this climate is to largely overlook the mortgage term. The reasoning behind this is that as you progress into the later years of the renewal term, rates may drop significantly. In such a scenario, it might be financially beneficial to pay the penalty to exit your current mortgage and renegotiate at the prevailing rate.

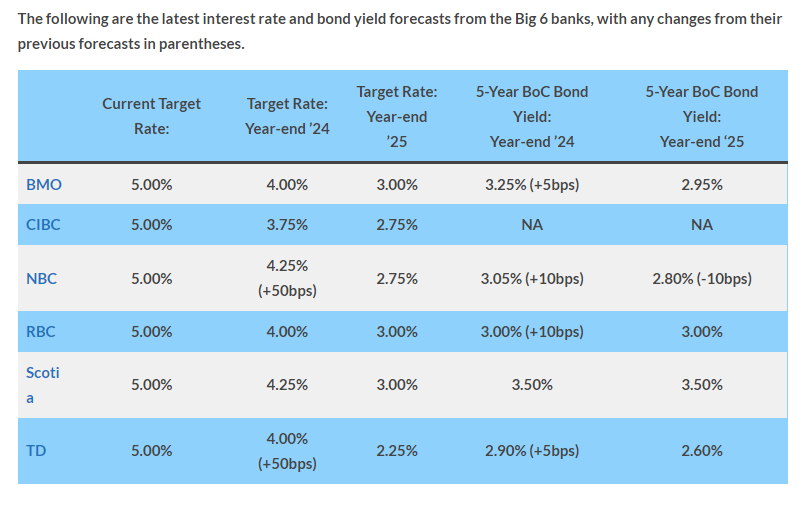

Moreover, consider the data below provided by Canadianmortgagetrends.com. Each example from identified banks indicates that all targets for 2025 are below 3.00%, with an average being 2.79%

Mortgage Calculations – Mitigate High-Interest Rates

Let's conduct some calculations using a $500,000 mortgage. Currently, if you were to sign a 5-year fixed mortgage with HuronMortgages.ca, the rate would be 4.99%, resulting in a monthly payment of $2,905.18.

Fast forward to December 2025, when the average rate is 2.79%. To break your mortgage, you would incur a 3-month penalty of $8,715.54, with a remaining balance of $478,701.

However, your new payment would be $2,214.17, allowing you to recoup the penalty in one year, not to mention the savings from securing the lowest rate available today.

This scenario exemplifies the adage 'When Life Gives You Lemons, Make Lemonade’.

The above strategy represents just one method to mitigate the impact of high-interest rates.

At HuronMortgages.ca, we offer various other strategies tailored to your specific situation. To explore additional options and tools, reach out to us for a consultation.

Keep in mind, our team at HuronMortgages.ca and MiGroup provides:

- Ease: Our mortgage brokers strive to make the process as seamless as possible, offering meetings in-person or over the phone and facilitating document exchange via email.

- No Cost: You will not incur any fees when utilizing our services; we are compensated by the lender.

- Competitive Rates: Benefit from lower mortgage rates through our volume discounts with top lenders.

- Access to Multiple Lenders: Gain access to a wide range of lenders, expanding your options beyond traditional banks and credit unions.

- Expert Advice: Rely on our expertise to navigate unique situations and receive tailored advice based on your needs.

- Impartiality: As independent brokers, we offer unbiased recommendations and guidance on various lenders and mortgage products.

Visit our website, call 519.497.3667 or email at any time at [email protected].

Licence #M18002043

Mortgage Intelligence FSRA

Licence #10428

HuronMortgages.ca operates as an independent marketing endeavour by Mathew Monks of Mortgage Intelligence Brokerage #10428.